Cooperation within CCRs

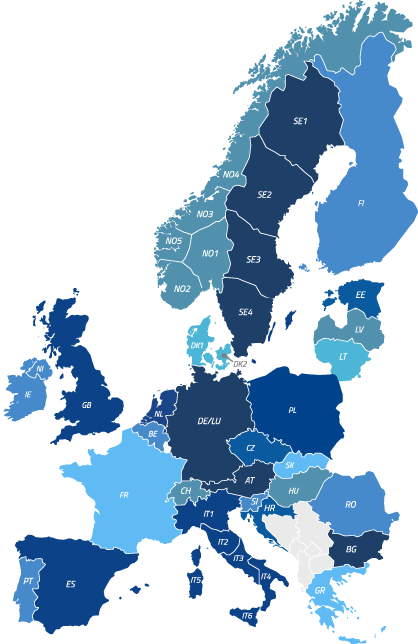

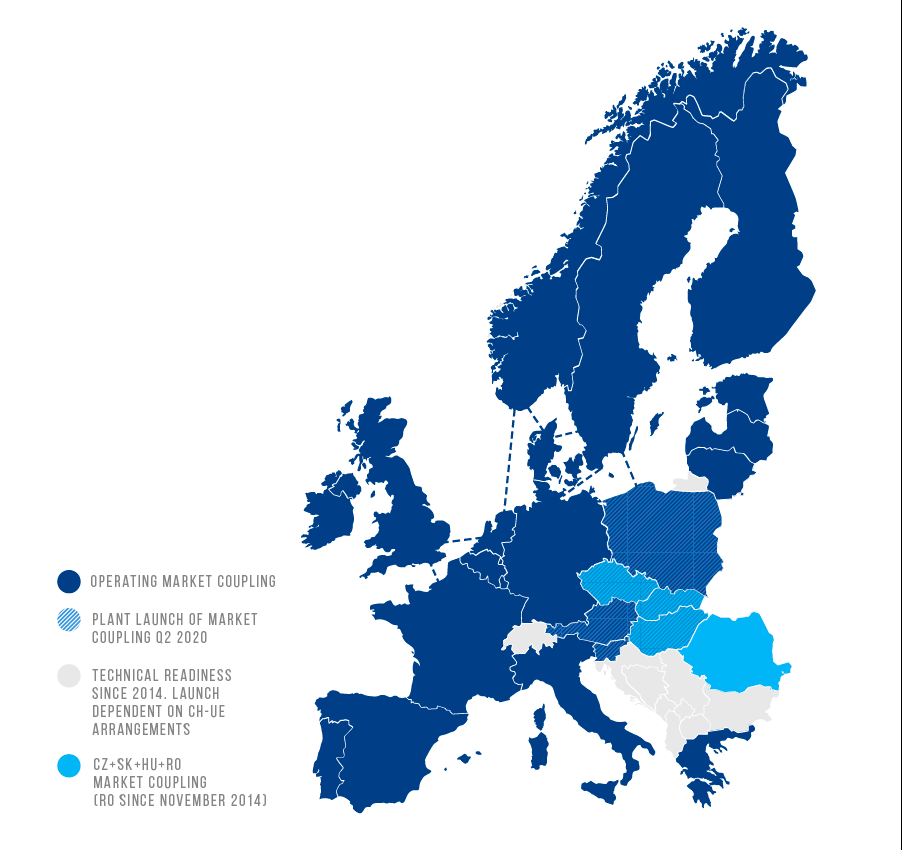

Poland is included in three capacity calculation regions (CCRs): CORE, Baltic and Hansa, established under a decision of the EU Agency for the Cooperation of Energy Regulators (ACER) in November 2016 on the proposal of all TSOs. Through the working structures of the above-mentioned regions, representatives of the individual TSOs, including PSE, carry on work aimed to implement market mechanisms whose design will ensure the capability for efficient, unconstrained and secure cross-border commercial exchange. The activities cover all market segments – from long-term markets, , through the day-ahead market (in the form of market coupling), to the intraday market – and they involve, among other things, the implementation of a coordinated process of capacity calculation, including the allocation of costs of remedial actions used in the process and implementation of the Market Coupling mechanism on the PPS interconnections.

Activities under the TSC initiative

We actively cooperate with European operators under the TSO Security Cooperation (TSC)initiative. The members of the TSC are 15 operators from Central Europe. The objective and main pillar of activity under the initiative is to increase the operational security of interconnected power systems, including PSE, through the intensification of regional inter-TSO cooperation, which currently involves threat identification processes and the use of relevant inter-TSO remedial measures. The key issues concerning the TSC initiative, including the strategy and directions of development, are decided upon by the TSC Cooperation Boardwhose Vice-Chairman is the President of the Management Board of PSE. Technical operational matters are the responsibility of the TSC Operational Board,on which PSE has its representative. A dozen or so representatives of our company are involved in activities resulting from the responsibilities of the TSC working structures.

Activity in the CEE Forum and CEEP

PSE also participates in:

- CEE Forum (Central Eastern European Forum for Electricity Market Integration) – a forum established to provided political support in the electricity markets integration process;

- CIGRE (French Conseil International des Grands Réseaux Électriques) – the world’s largest international association grouping together experts dealing with electricity generation, transmission and distribution issues. In coordination with the association, we work on promoting innovations and new solutions in the power sector through cooperation between business and the academy);

- CEEP (Central Europe Energy Partners) – an international non-profit association representing the Central European energy sector, whose objective is to support the integration of the Central European energy sector within the framework of the EU common energy and security policy. The Chairman of the CEEP Board of Directors is a representative of PSE.

PSE’s international cooperation includes not only work in the organisations and initiatives mentioned. We are also active under many international projects, such as SIDC (also known as XBID), SDAC (formerly MRC) and other projects implementing the provisions of network codes and EC guidelines.